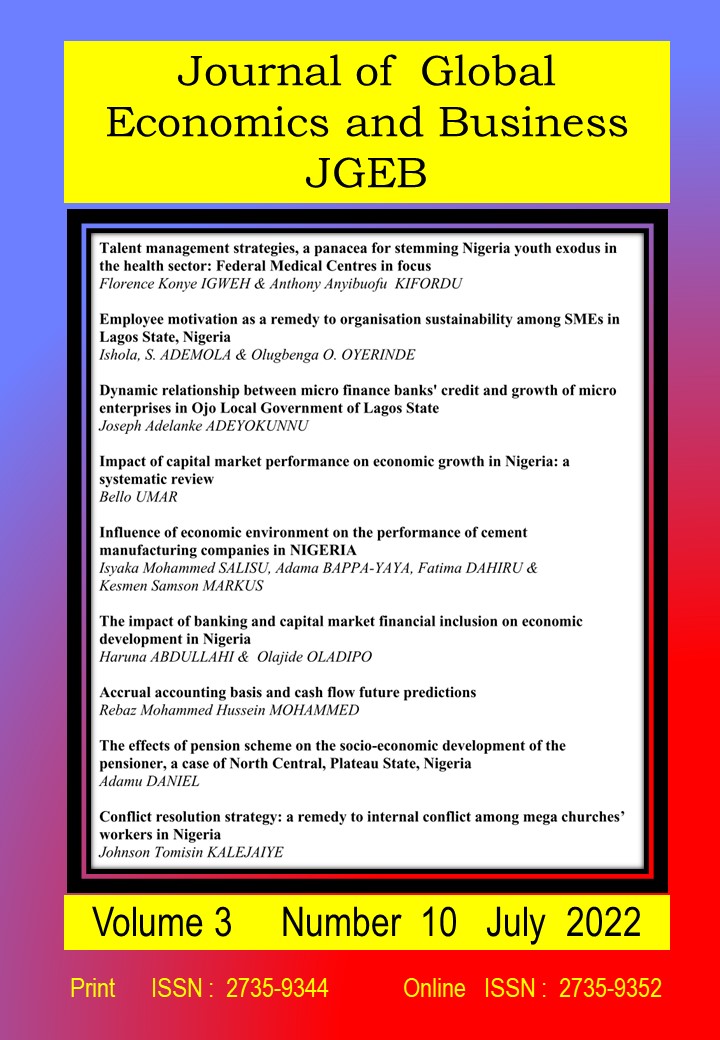

Dynamic relationship between micro finance banks' credit and growth of micro enterprises in Ojo Local Government of Lagos State

Keywords:

Micro Credit, MSMEs, MFBs, Micro Finace BanksAbstract

The Micro, Small and Medium Enterprises (MSMEs) challenges appear to be enormous and Micro Finance Banks (MFBs) thereby declining their capacities of contributing to the stability of MSMEs and decrease the rate of their performance. The failure to present required collateral or demonstrate good dignity by most MSMEs seem to be the major challenges which MSMEs are facing in today’s dynamic business environment. This study, therefore, examines the dynamics relationship between MFBs and the growth of MSMEs in Ojo Local Government Area of Lagos state, Nigeria. The study employed a cross-sectional research design, while a multi-stage sampling technique was used for the study. 120 copies of the questionnaire were distributed, 97 were returned and found fit. Frequency distribution (percentage analysis) was used to analyse data. The findings revealed that MFBs have dynamic relationship with MSMEs in Ojo Local Government Area of Lagos State. The study concludes that the MFBs and MSMEs in Ojo Local Government Area of Lagos State are vital to the survival of one another. Thus, it was recommended that owners/managers of MSMEs should make use of MFBs opportunity to grow and develop their businesses from time to time.